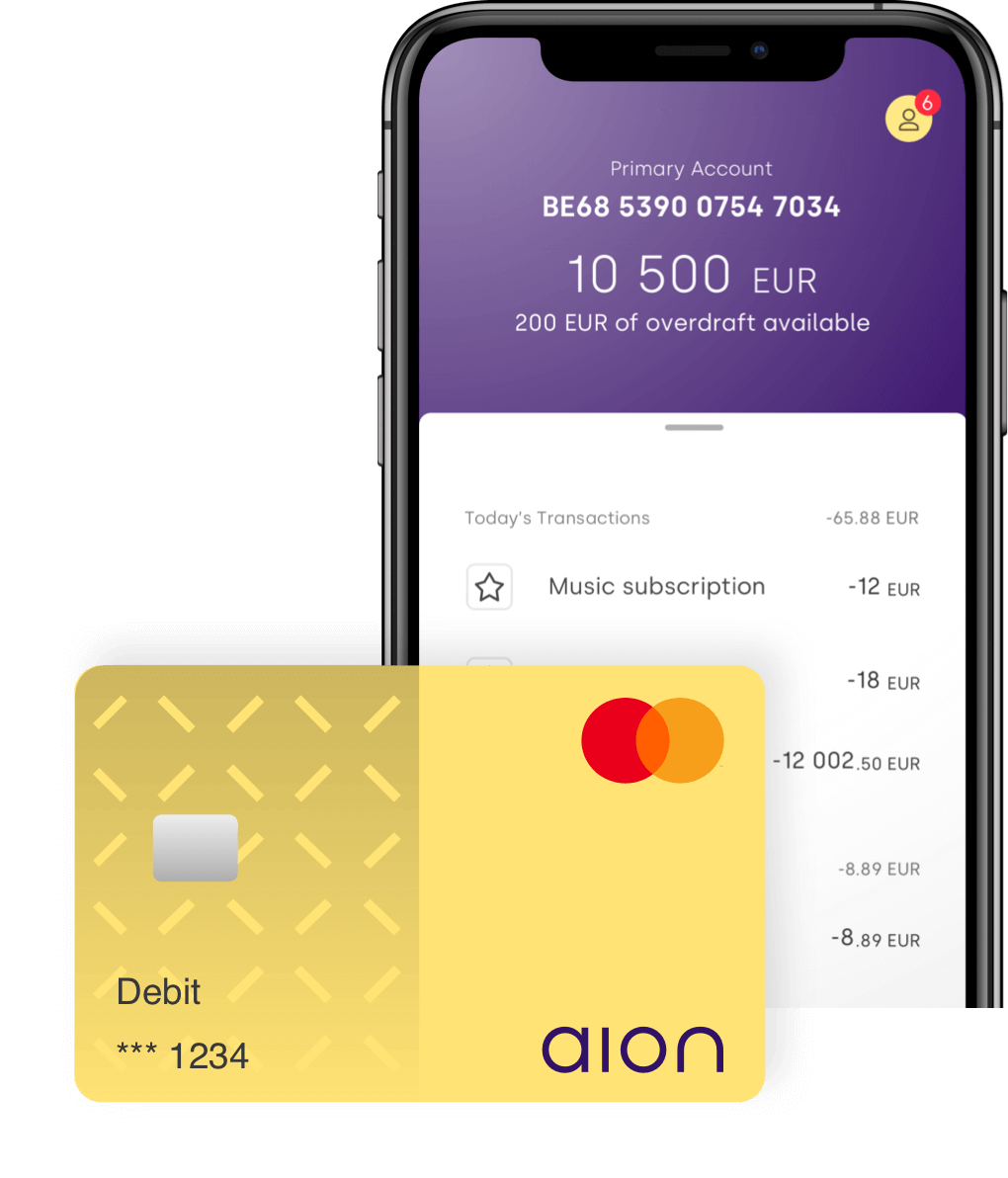

✔ One of the highest interest rates for savings accounts

✔ Fully digital banking made easy

✔ One monthly fee

Immediate access to our exclusive products

✔ Start right away: all you need is a smartphone.

✔ You can stay with your home bank and use our products to turbo-boost your finances.

✔ You can stay with your home bank and use our products to turbo-boost your finances.

Watch video (00:14)

Fully digital banking made easy

✔ You are in control: access your finances whenever and wherever you want.

✔ 100% of services can be started via our app.

✔ Say goodbye to branch visits and card readers.

✔ 100% of services can be started via our app.

✔ Say goodbye to branch visits and card readers.

Watch video (00:27)

“The Netflix of Banking”

“An entirely transparent model that will change the way you bank”