A Term Deposit on your terms

- When the term is over, you can withdraw or continue.

- You decide the amount and the period of the deposit.

- The funds transferred on a term deposit are blocked during the term.

- You see immediately the estimated interest you'll earn.

- You can select automatic renewal on the Term Deposit in the app.

Type of product

Term deposit subject to Belgian law with a fixed duration and interest rate.

The funds transferred on a term deposit are blocked during the term.

The Term Deposit cannot be early terminated and the Bank will not reimburse that capital invested on a Term Deposit before the end of the applicable duration unless otherwise agreed with the Bank. If, however, the Bank accepts the early termination of a Term Deposit, any revenues which have not already been distributed will not be distributed and will be retained by the Bank as compensation.

The Term deposit account is for mobile clients only.

Foreign Currencies account

The Bank offers Term Deposit accounts denominated in USD only to clients who already hold a USD currency account with the Bank. The Term Deposit product does not include any foreign exchange (FX) services. Accordingly, a Term Deposit in USD may only be opened and funded with USD from an existing USD account held by the saver at the Bank. Upon maturity or early termination of the Term Deposit denominated in USD, the funds will be returned in USD exclusively, without conversion.

Tax regime

Interest is subject to a 30% withholding tax for natural persons who are residents in Belgium.

Risks

Risk of bankruptcy: in case of bankruptcy or risk of bankruptcy of the financial institution, the saver runs the risk of not recovering his/her savings or may be subject to a diminution / conversion in shares (Bail-in) of the amount of the claims he/she holds against the financial institution in excess of EUR 100 000, i.e. the amount falling within the scope of the deposit guarantee scheme.

Eligible deposits with the Bank are protected up to €100,000 per person, all accounts combined.

Risk of inflation: the continuing rise in prices could cause the money deposited to lose value.

Exchange rate risk: for foreign currency term accounts, exchange rate fluctuations may affect the value

of your deposit and result in a loss on the amount initially invested.

Complaints

You can send your complaints to us using our chat or writing an email to complaint@aion.be.

If you are not satisfied with the solution proposed by the Bank, you may contact Ombudsfin. To submit your complaint and ensure faster handling, please use the form available on the website http://www.ombudsfin.be/en/introduce-a-complaint. E-mail (only if you encounter a problem with the web form): ombudsman@ombudsfin.be.

Capitalisation

Interest earned will be credited to the deposit account at maturity.

Autorenewal

You can manage the AutoRenewal option directly in the product section of the mobile app.

The latest date to oppose auto-renewal is one day before the maturity of the term deposit. You have the right to terminate the contract at any time, without penalty via the mobile app.

Interests rates applicable for deposits (EUR)

Interests rates applicable for deposits (USD)

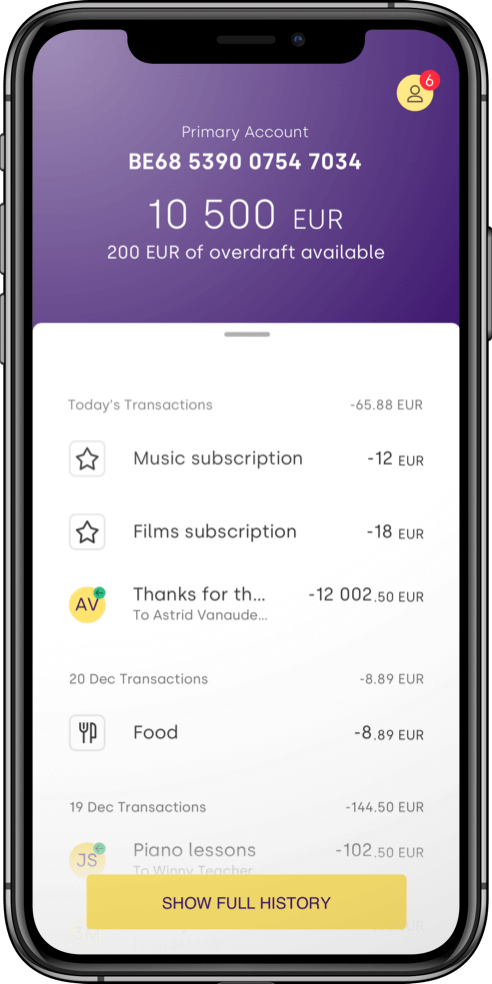

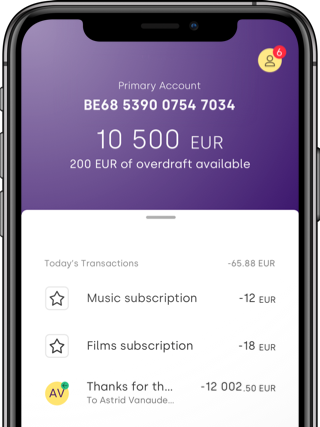

Digital banking at its best

- Signing up is fast and easy with our fully digital process.

- Manage your money from anywhere.

- Discover even more ways to save and earn money.

Unfortunately, sending a text message

is currently not available.

Don't worry and try again tomorrow.

In the meantime you can search for Aion Bank applicationon Google Play, App Store and App Gallery:

- No key information is available or required by law for term deposits.

- Before opening an account, carefully read the deposit guarantee information sheet available below.