What does our Extended Savings Account offer?

- You receive a base rate of 0.5%.

- You receive a 1.15% fidelity premium for deposits that are on your account for longer than 1 year.

- And exempt from 15% withholding tax on the first €1050 of interest earned in 2025.

Type of product

Our Extended Regulated Savings Account is free of charge and is opened for an indefinite duration. Your money is always available without any costs.

Our Extended Regulated Savings Account is a category A savings account subject to Belgian law, i.e. a “classic” savings account with no conditions applicable to either the base interest rate or the loyalty premium, and complying with the conditions set out in Article 2 of the Royal Decree executing the Income Tax Code 1992. It is for mobile clients only.

Our Extended Regulated Savings Account is a regulated savings account. For more information on categories, please consult Wikifin’s website.

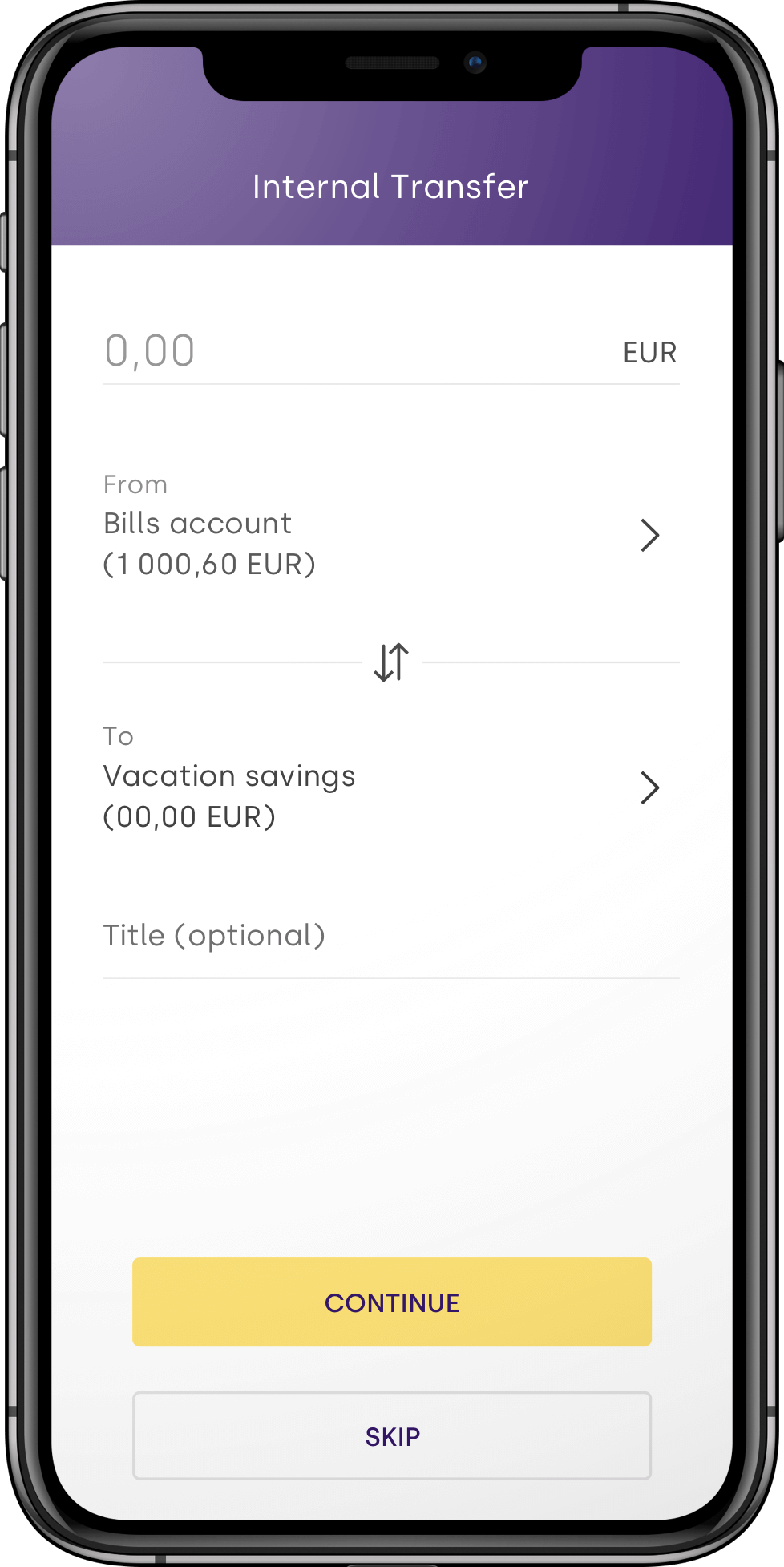

If money is transferred from a savings account to another savings account opened in the name of the same account holder at the same institution, other than through a standing order, the period during which the loyalty premium was accrued on the first savings account will be maintained, provided that the amount of the transfer is at least €500 and that the account holder concerned has not already made three such transfers from the same savings account during the same calendar year.

Our regulated savings accounts Extended offers a 0.50% base rate with a 1.15% fidelity premium. Our Extended regulated saving accounts are for savers seeking less flexibility and who are able to leave their funds in the account for at least 12 months. The base interest is acquired as from the day the money is deposited on the account and until the day of withdrawal. The fidelity premium is only acquired on the amounts which have stayed uninterruptedly on the regulated savings account for 12 months following the deposit. This means that if you withdraw your money before the end of the 12 months, you will not be entitled to the fidelity premium. The rate of the fidelity premium in force at the time of the deposit or the start of a new acquisition period remains unchanged for a period of 12 months. If the rate of the fidelity premium in force changes after you deposited the money on the account, this money will only be capitalised at the new rate one year after the money is deposited.

The base rate is paid on the value date of 1 January. The already-acquired fidelity premium is paid on 1 January, 1 April, 1 July and 1 October.

Before opening an account, please read the key information for savers and the deposit guarantee information sheet below.

The rates on our savings accounts can be changed at any given time. Clients will be notified through their account statements of changes in the rates above.

Taxation

Withholding tax is not due on the first tranche of interest received (up to a ceiling of €1,050 for the 2025 income year) per account, per natural person resident in Belgium and per year. This amount is doubled for accounts opened in the name of married or legally cohabiting partners (i.e. a ceiling of €2,100 for the 2025 income year). The withholding tax is 15% on all interest above the ceiling. We automatically withhold this tax at source. If you hold several savings accounts, you must specify the interest received above the ceiling that is not subject to withholding tax on your tax return.

Risks

Insolvency risk: In the event of the insolvency or risk of insolvency of the financial institution, depositors risk not recovering their savings or may be required to reduce/convert the amount of their claims against the financial institution above €100,000, an amount covered by the deposit protection mechanism, into capital shares (Bail-in). More information on this protection mechanism can be found on the website of the Guarantee Fund (https://garantiefonds.belgium.be/en).

Risk of inflation: the continuing rise in prices could cause the money deposited to lose value.

Complaints

You can send your complaints to us using our chat or write an email to: complaint@aion.be. If you are not satisfied, contact bank mediation service at: www.ombudsfin.be

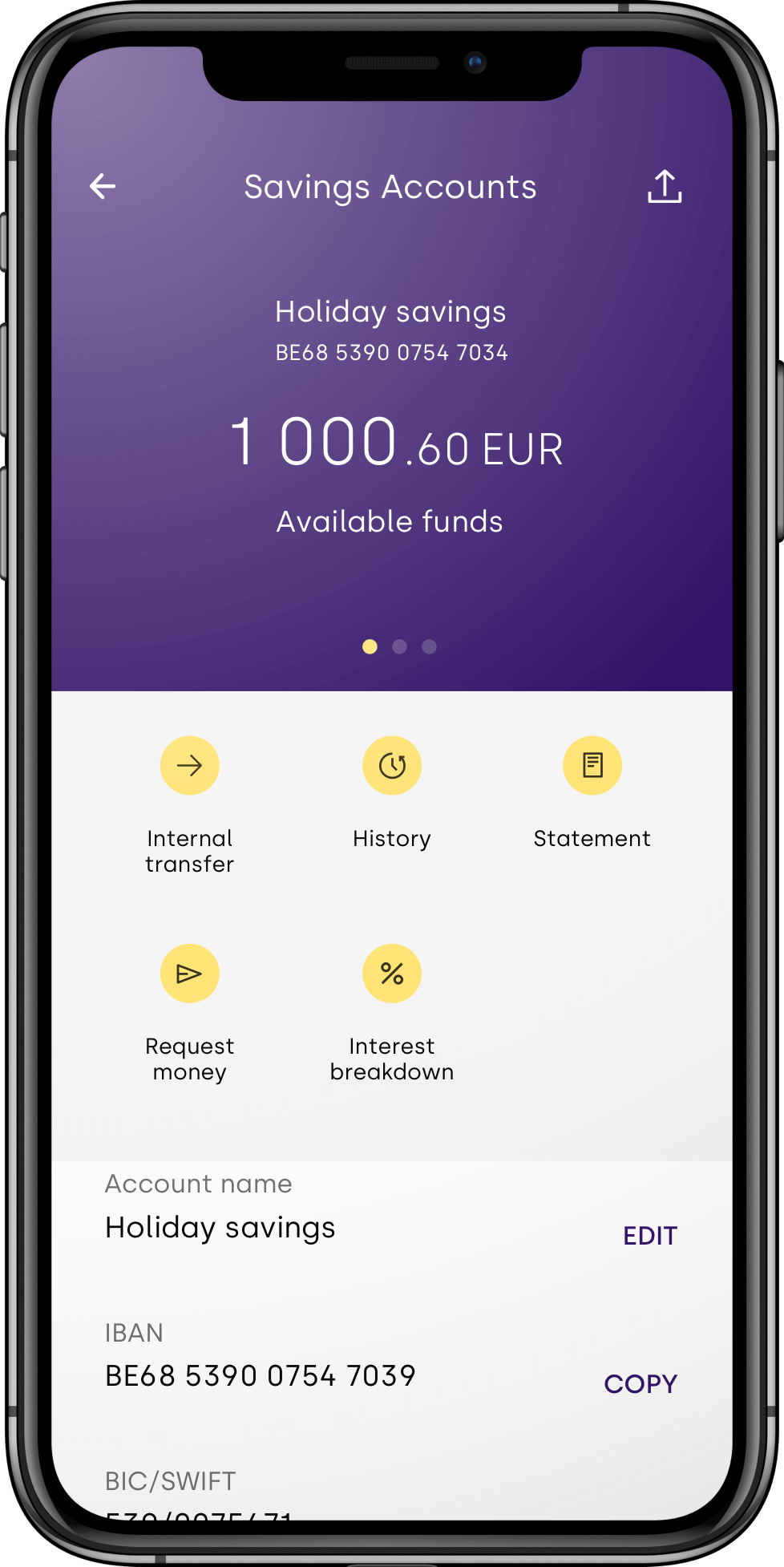

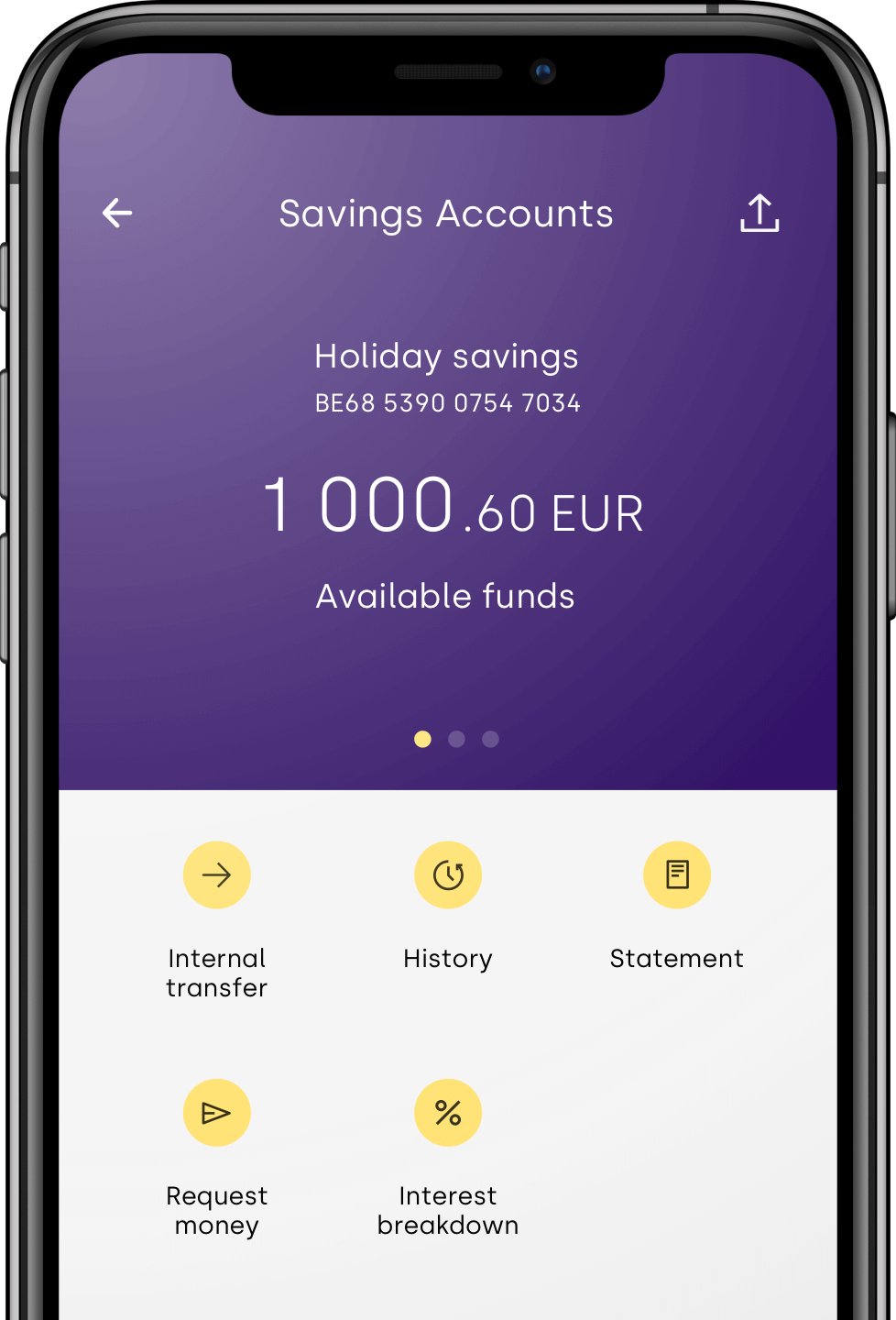

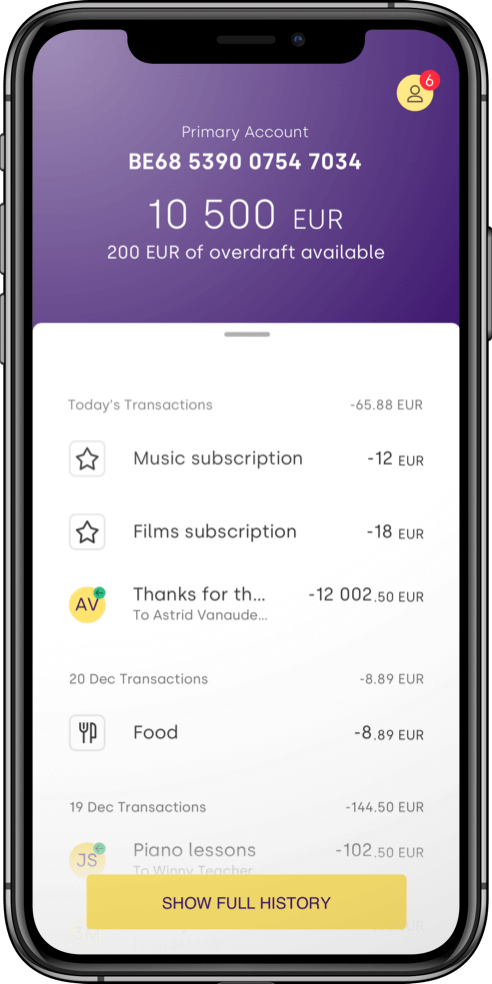

How does it work?

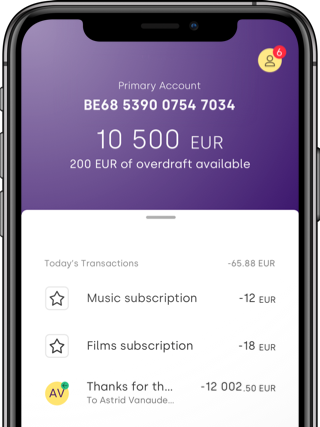

- Download the Aion Bank app.

- Open an account within minutes.

- Go to the Finance tab and select ‘open new savings account’.

- Select the Extended Savings Account.

Digital banking at its best

- Signing up is fast and easy with our fully digital process.

- Manage your money from anywhere.

- Discover even more ways to save and earn money.

Unfortunately, sending a text message

is currently not available.

Don't worry and try again tomorrow.

In the meantime you can search for Aion Bank applicationon Google Play, App Store and App Gallery:

Aion Bank NV/SA, a credit institution incorporated as a company limited by shares under the laws of Belgium, with registered office at Sq. Victoria Régina 1, 1210 Saint-Josse-ten-Noode Brussels, Belgium, registered with the Crossroads Bank of Enterprises under number 403.199.306, VAT BE403.199.306.