The Aion Bank Q1-Q2 Mobile Banking Report

Due to Coronavirus, we have seen a dramatic change in not just the amounts Belgian people are spending, but the methods in which money is being spent. We know consumer habits are shifting due to the pandemic, and our integration with Apple and Google Pay has helped our members shop safely and efficiently throughout 2020.

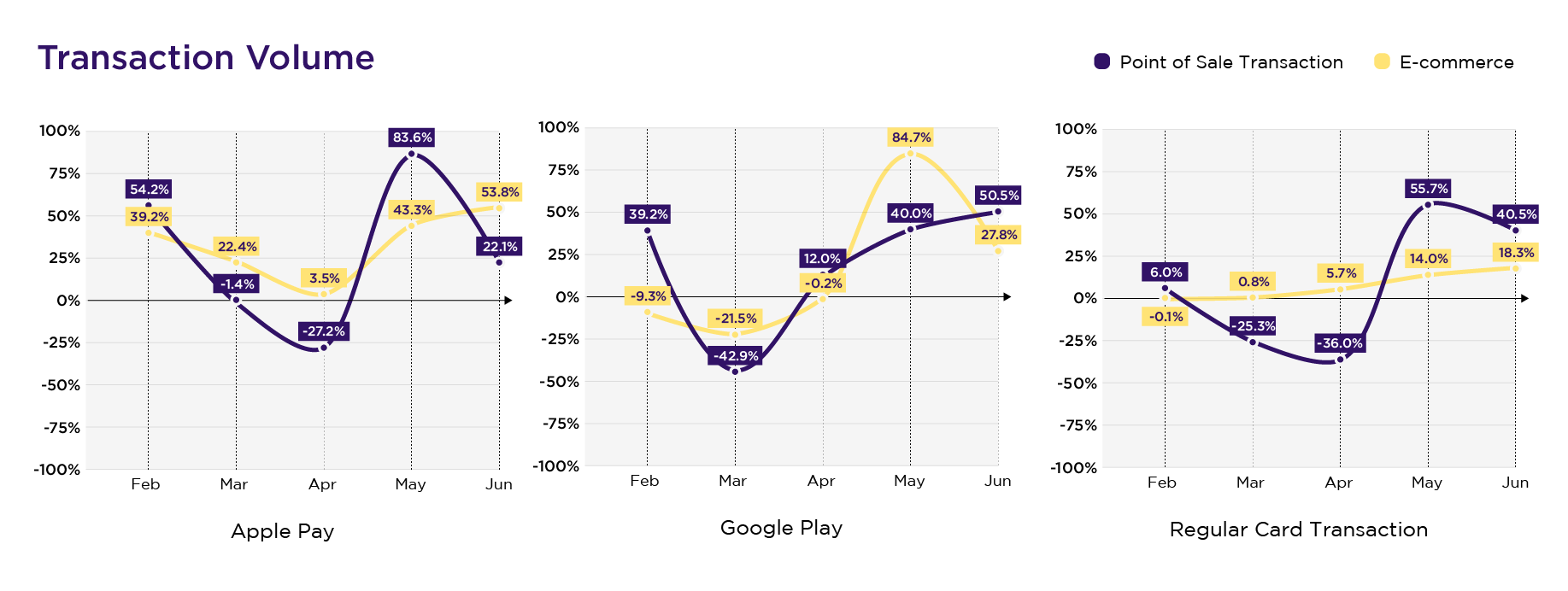

Using our data, we monitored shopping habits in relation to point-of-sale transactions and e-commerce payments across the first six months of the year. We looked at methods of payment, volume of spend, amount of purchases and the average value of transactions.

Rate of spending

Our data shows that mobile wallets are continuing to grow in frequency and popularity. Between Q1 and Q2, we saw a 43% rise in the volume of spend with mobile wallets, while regular card payments in stores and for e-commerce remained relatively stable.

Over the May and June period, the change in lockdown restrictions impacted the way people spent, with a 68% surge in payments via mobile both in stores and online. For Apple Pay, the highest increase was between April and May where we saw a 84% rise in spending in stores.

Below is a breakdown of the amount spent by each method of payment between January and June, and the percentage increases month on month.

Spend per transaction

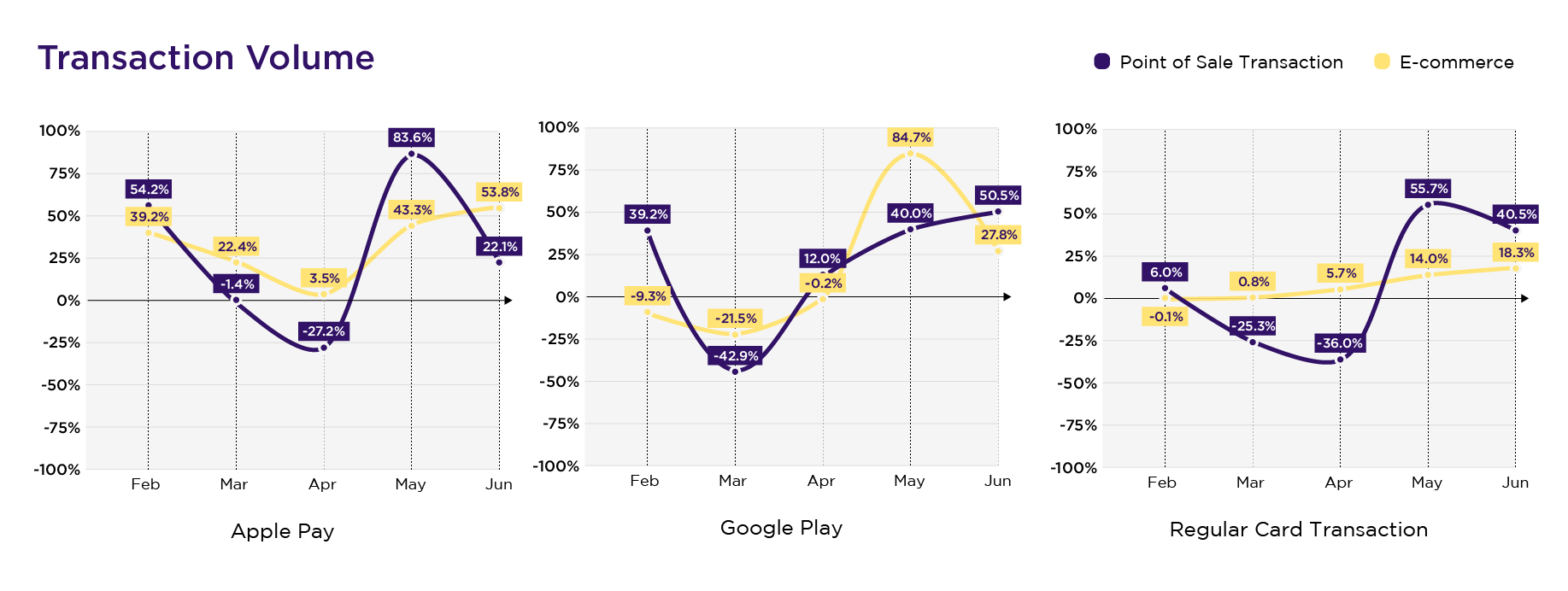

Data between May and June show that the level of spend per e-commerce transaction on Apple Pay increased by 63%. In this same period, the average amount being spent per purchase in stores was lower due to the frequency of transactions via mobile. According to our data, members spent almost half as much per transaction through mobile payment than regular card transactions when shopping in stores. This showcases the preference for mobile wallets for more everyday purchases.

Below is a breakdown of the average transaction value for point-of-sale paymentsv.s. e-commerce purchases for Apple Pay, Google Pay and regular card payments.

E-commerce v.s. Point of Sale

As well as monitoring data across different months, we also analysed where people were spending their money. Unsurprisingly, lockdown meant that more people were doing their spending via e-commerce and not in stores. Between March and April, point-of-sale transactions went down 45% across all methods of payment, whilst in the same period Apple Pay spend volume rose 13%. Whilst figures for point-of-sale spending noticeably recovered in recent months, the rate of e-commerce spending still continues to rise month on month.

Kim Van Esbroeck, Country Head for Belgium, Aion Bank, spoke of the data, commenting: “COVID-19 proved the importance of digitisation within payments and banking services, which has led to the growth for payments with mobile wallets. Aion launched in the middle of Belgium’s lockdown, and we were able to fully serve our members remotely from day one. It is clear that certain consumer habits like mobile payments were expedited by the pandemic, and we are responding to our members’ new normal by continuing to innovate to make banking out-of-home as easy and frictionless as possible.”