How has the Covid-19 pandemic impacted savers’ priorities?

This month marks a year since Belgium went into lockdown and the pandemic first had its impact on the economy. The pandemic has affected Belgians in different ways - some have reduced their household spending and been able to save money, whilst for others, household income and savings have been impacted. Ultimately, the pandemic’s disruption to our lifestyle has affected everyone’s spending and saving habits.

For most, government policies, such as tax reductions or delayed repayments to support loss of income, have allowed people to save which means that household savings have risen on average across Belgium.

In this report, Aion Bank, a full service digital bank, explores how consumer behaviours around saving have evolved during the first lockdown until today.

59% of Belgians have been able to save during the pandemic

Our survey showed that 59% of Belgians have been able to save during the pandemic, increasing to 68% of those aged 25 - 34, but decreasing to 45% of those aged 55 plus.

When breaking this down by region, 68% of residents living in the Brussels-Capital Region were able to save while only 58% in the Flemish Region and 55% in the Walloon Region were able to save. This may be due to higher wages seen in the Brussels-Capital Region.

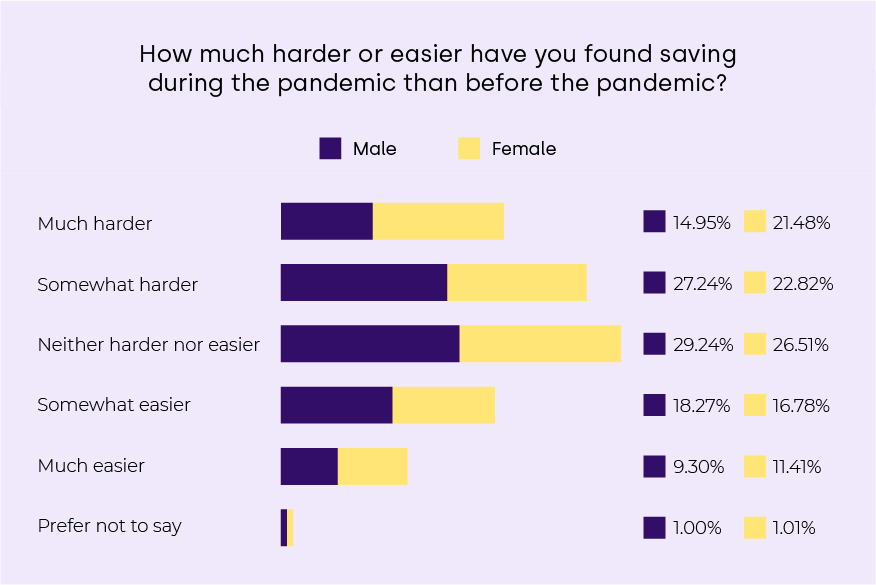

While most Belgians have been able to save, 18% claimed that it was much harder, with 25% finding it somewhat harder. Only 10% claimed it was much easier, with 18% finding it somewhat easier and 28% stated they found it neither harder nor easier to save.

Financially supporting relatives has impacted people’s ability to save

When asked why it has been harder to save during the pandemic, 50% cited a decline in household income, while 42% claimed it was because they had to financially support relatives during the pandemic.

Of those who found it easier to save during the pandemic, 55% cited a reduction in living expenses as the main reason, while 38% specifically called out lack of commuting as the reason they were able to save.

11% of people have no savings, an increase of 3%

While more people overall have been able to save, there was also an increase in the number of people with no savings over the pandemic period, rising from 8% to 11%, according to our survey. This is seen across all age groups.

Despite this, there are now 3% more people who have savings of over €2001 due to being able to save more during the pandemic.

When comparing the number of people who had over €20,000 saved before the pandemic to now, there’s been a 0.5% increase. However, according to those surveyed only men were able to do this.

Across age groups, it was those aged 16-24 and 45-54 that were able to increase their savings the most - of those surveyed, 9% more people in each age group now have savings of more than €2001, whereas pre-pandemic they had less.

This is the opposite though for those aged 55+; a decline of 1% of people have over €2001 in savings now in comparison to before the pandemic. This is perhaps as a result of having to support other relatives through such turbulent times.

49% of people claim the pandemic has impacted what they’re saving for

When asked if the pandemic has impacted what they’re saving for, 49% of respondents claimed that it had, while 14% claimed that they’re saving for nothing in particular.

For those who have changed their saving aims over the past year, we asked what they were saving for pre-pandemic in comparison to what they’re saving for now.

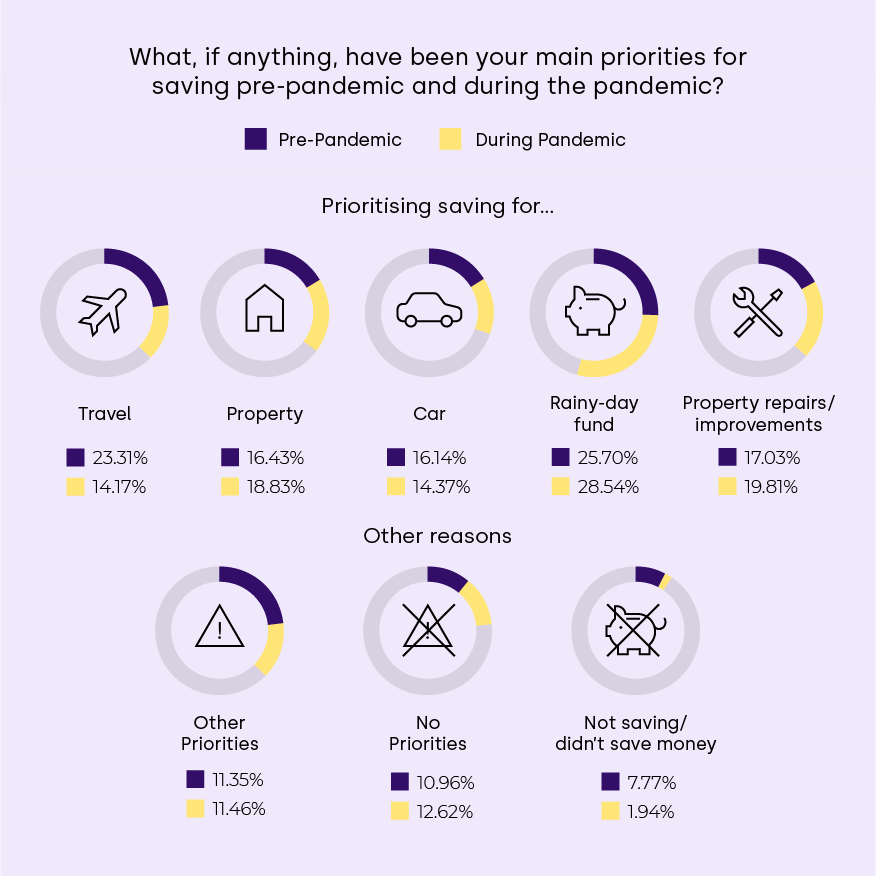

According to our findings, fewer people are saving for travel, with only 14% claiming that they’d use their savings for travelling now compared to 23% that were saving for this activity pre-pandemic.

A small increase of 2% of people are now saving for a property. Additionally, a further 3% of people are now saving to improve their property, which may be as a result of spending more time at home and wanting to invest in their surroundings.

Interestingly, there’s been an increase in 3% of people prioritising saving for a rainy-day fund, suggesting that the pandemic has encouraged people to become more conscious of their spendings and to be more prepared for the future.

Before the pandemic, 8% of respondents were not actively saving their money. Today, this drops rapidly to just 2% of those we surveyed citing they are not saving money, meaning 98% of people are looking after their money and increasing their savings regardless of their priority.

Those wanting to save for a car have also slightly dropped, from 16% pre-pandemic, to 14% now. A further 3% of people, increasing to 20% from 17%, are also saving more for property renovations.

Women are more likely to be saving money for their rainy day funds (30% compared to men's 27%) or property repairs (22% opposed to 18%).

Men, however, are more likely to prioritise saving for a property (20% compared to 18% of females), or saving for no specific priority (15% compared to women’s 10%).

Most people think their plans to buy a property have been delayed

As part of our survey, we explored the pandemic’s impact on those wishing to save for a property.

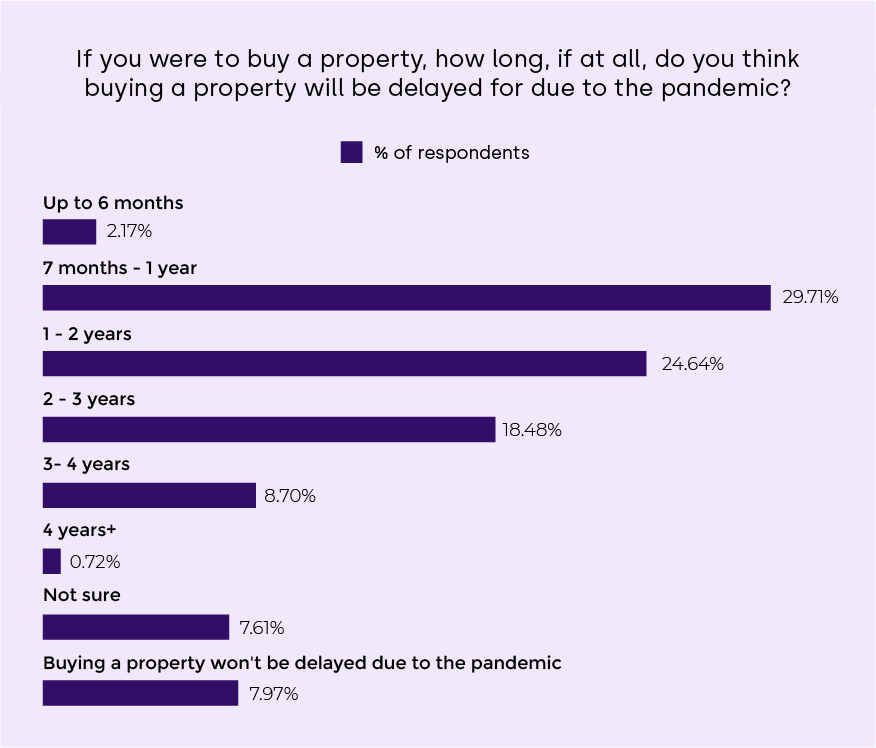

47% of survey respondents are planning to purchase a property. We found that most people feel their ability to purchase a property has been delayed as a result of the pandemic (84%), and, for most (30% of those surveyed), this delay in purchasing a property is between 7 months to a year.

It’s clear that those aged 16-24 have been affected the most by the pandemic when it comes to getting on the property ladder.

Almost half (46%) of the people surveyed aged 16-24 claimed they would be getting on the property ladder pre-pandemic, but only 30% of this group now believe this.

The pandemic has allowed people to review their spending situation, with 18% of respondents planning on spending up to €50,000 on a property before the pandemic. This figure drops to 14% today, meaning at least 4% of individuals are hoping to buy a more expensive property.

…

It is important to employ smart money saving strategies, as having a rainy-day fund will help to protect you in the event of a financial emergency and help to achieve goals such as getting on the property market. Additionally, Belgians need to consider how rising inflation and low interest rate savings accounts will essentially make their savings worthless.

However, some banks like Aion Bank are actively creating more ways for Belgians to maximise their money. Aion Bank currently offers one of the highest interest rate savings accounts in Belgium, according to Spaargids.

Some people have had to cut back on household spending and change their saving priorities in order to navigate the pandemic. With businesses opening up again, the real test will be to maintain the savings habits post pandemic and for people to maximise their money as the economy improves.

Methodology

We surveyed 1,004 members of the Belgium population in March 2021 in order to reveal the findings.