A Term Deposit on your terms

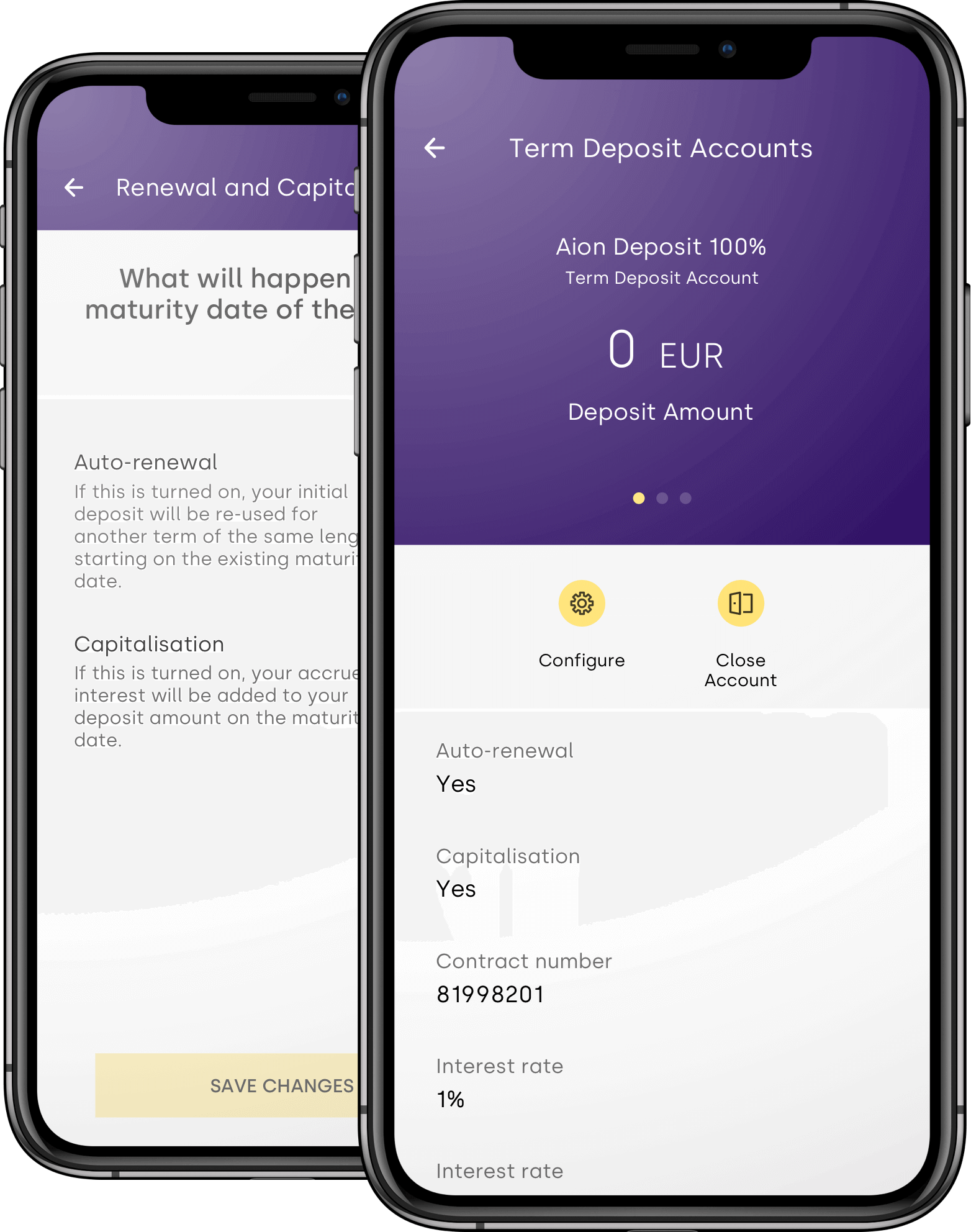

- When the term is over, you can withdraw or continue.

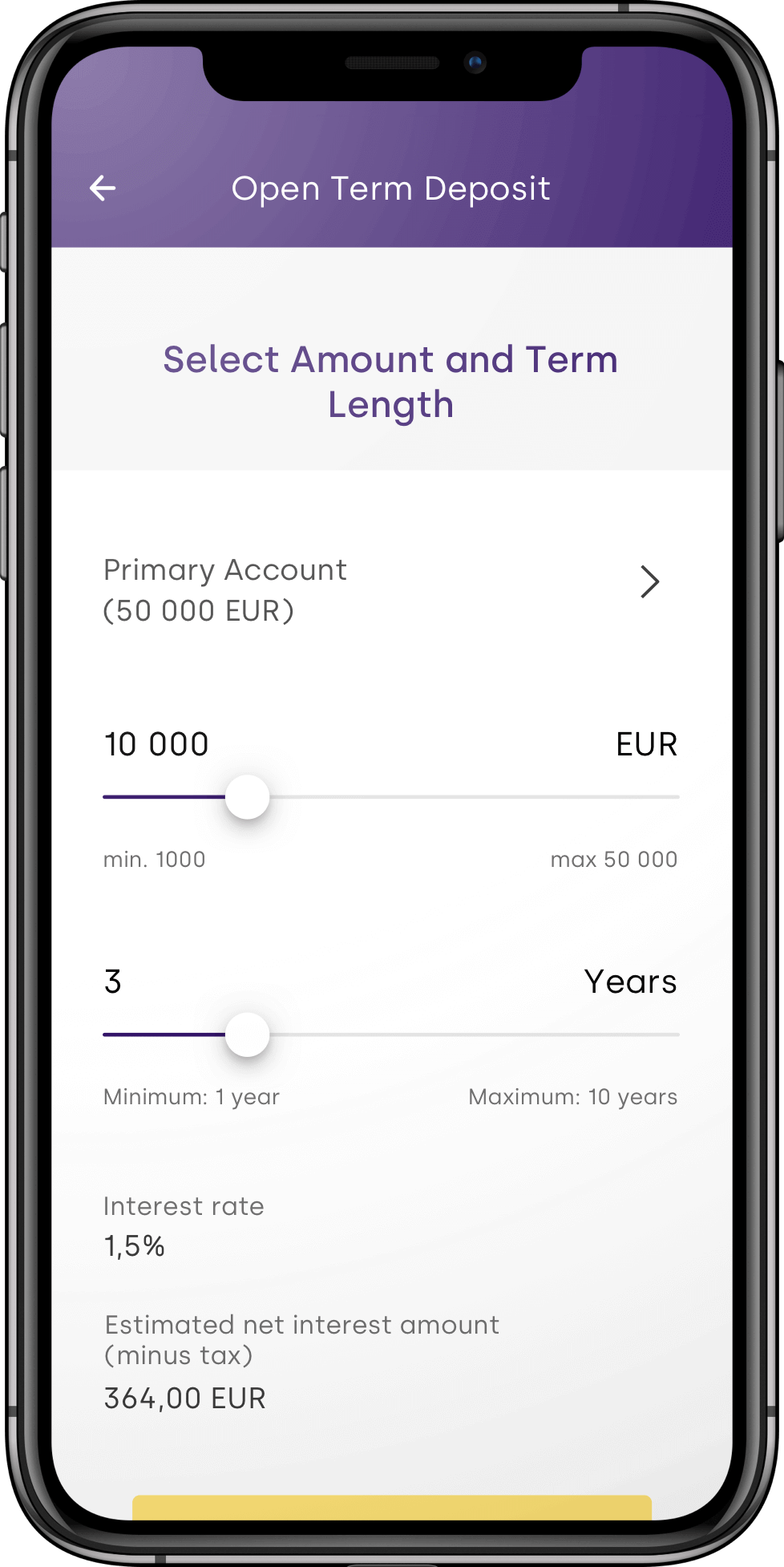

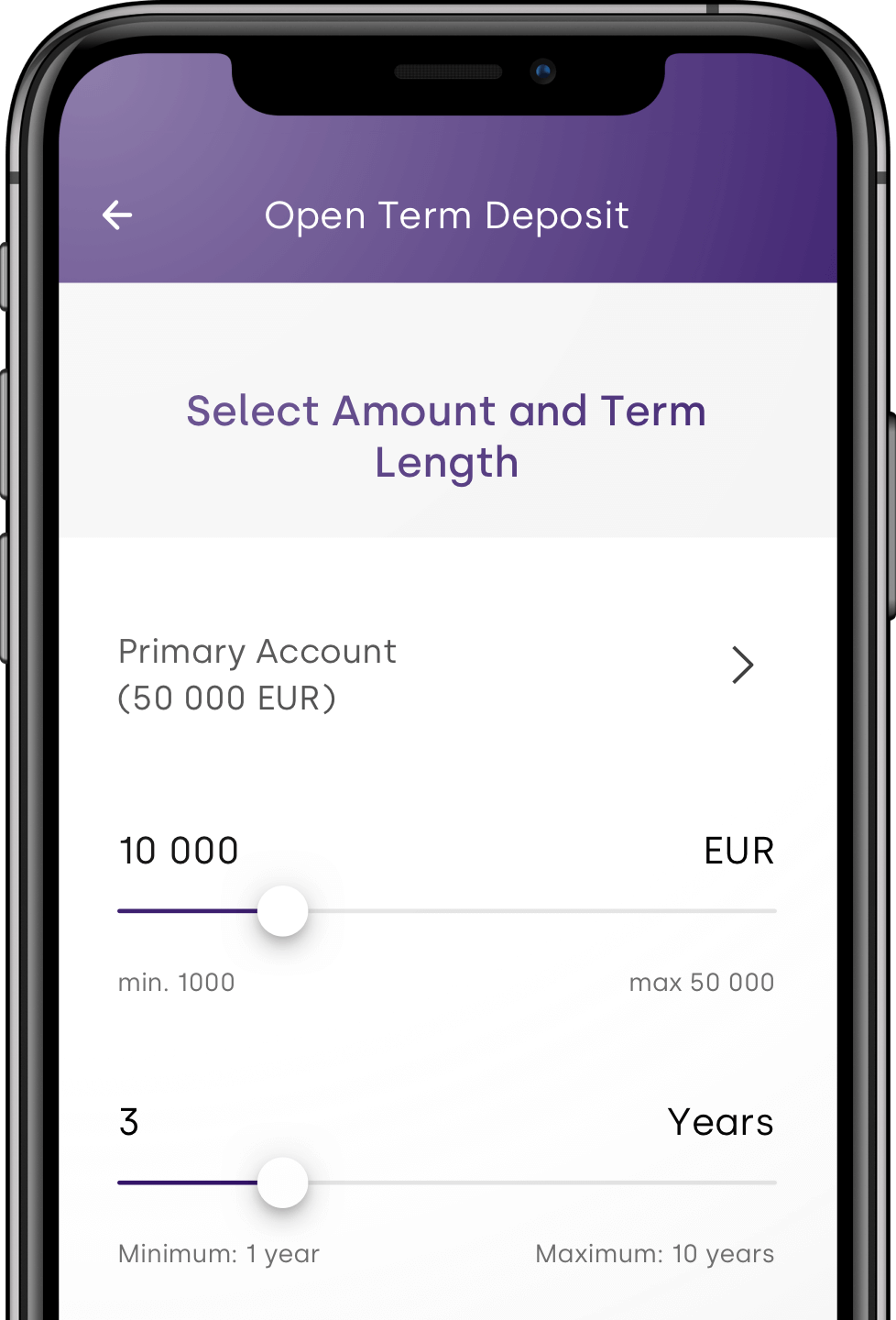

- You decide the amount and the period of the deposit.

- You see immediately the estimated interest you'll earn.

- You can select automatic renewal on the Term Deposit in the app.

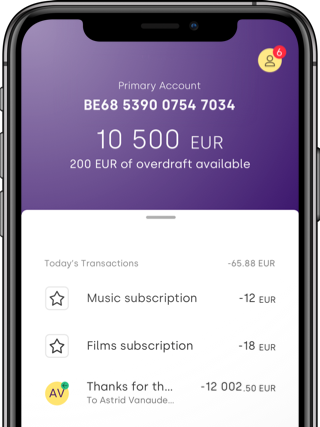

Digital banking at its best

- Signing up is fast and easy with our fully digital process.

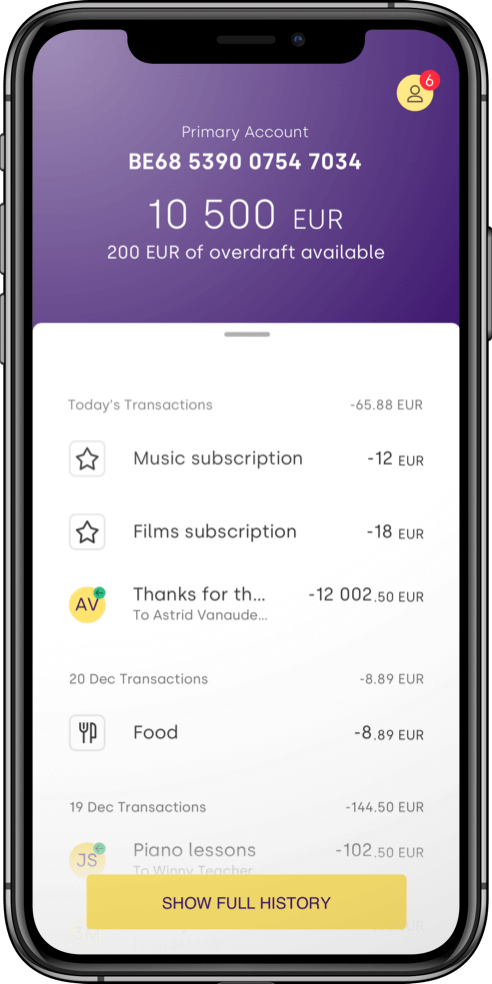

- Manage your money from anywhere.

- Discover even more ways to save and earn money.

Unfortunately, sending a text message

is currently not available.

Don't worry and try again tomorrow.

In the meantime you can search for Aion Bank applicationon Google Play, App Store and App Gallery:

- No key information is available or required by law for term deposits.

- Before opening an account, carefully read the deposit guarantee information sheet available below.

Documents

Type of product

Term deposit subject to Belgian law with a fixed duration and interest rate.

The funds transferred on a term deposit are blocked during the term.

The Term Deposit cannot be early terminated and the Bank will not reimburse that capital invested on a Term Deposit before the end of the applicable duration unless otherwise agreed with the Bank. If, however, the Bank accepts the early termination of a Term Deposit, any revenues which have not already been distributed will not be distributed and will be retained by the Bank as compensation.

Tax regime

Interests are subject to a withholding tax of 30%.

Risks

Your deposits are protected up to EUR 100 000 per person.

Risk of bankruptcy: in case of bankruptcy or risk of bankruptcy of the financial institution, the saver runs the risk of not recovering his/her savings or may be subject to a diminution / conversion in shares (Bail-in) of the amount of the claims he/she holds against the financial institution in excess of EUR 100 000, i.e. the amount falling within the scope of the deposit guarantee scheme.

Risk of inflation: the continuing rise in prices could cause the money deposited to lose value.

Complaints

You can send your complaints to us using our chat or write an email to complaint@aion.be.

If you are not satisfied, contact bank mediation service at www.ombfin.be.